The Trump 2017 Tax Cuts and Jobs Act reduced taxes in all brackets, and on the campaign trail, Trump promised to cut taxes even further, especially for corporations and the America’s most wealthy. But with this tax cut comes a loss of revenue for the federal government, something seemingly in conflict with Trump’s desire to balance the budget and reduce the federal deficit. This post is the first of several that will outline what actions Trump is taking to cut federal spending and what impact these cuts will have on everyday Americans.

Trump’s Tax Plan

The tax bill Trump passed in 2017, which will expire later this year, promised tax cuts that would benefit taxpayers from all tax brackets and trickle-down economic benefits due to its disproportionate cut to the top 1% of taxpayers. However, this tax cut primarily benefited the wealthiest of Americans, with most of its economic benefits seen reflected in the salaries of companies’ top earners, and it is estimated to cost the federal government at an estimated $1.9 trillion over the course of ten years, according to the Congressional Budget Office (CBO).

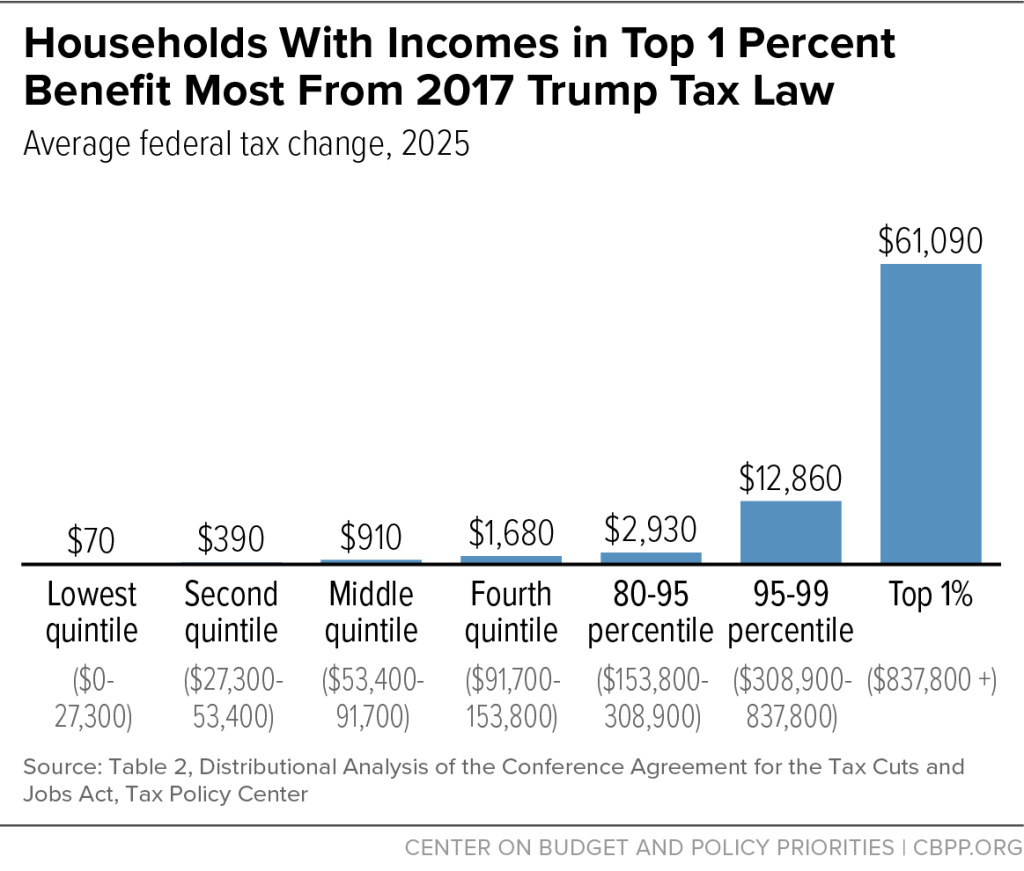

As seen in the graph above, the average savings in taxes for households making over $837,800 a year was $61,090, about a 2.9% boost in savings in comparison to the previous tax system. This is around triple the 0.9% boost in savings seen by the bottom 60% of earners in the United States. It is important to note that this is just the average, and the gap widens even further when considering that the top .1% of earners in the United States received an average of $252,300 in savings from the 2017 tax cut.

Still, Trump and Republicans that supported this tax plan promised that the money saved by the wealthy in taxes would trickle down economically to the average employee, and yet, evidence has shown the contrary. According to the Center on Budget and Policy Priorities, “Trump Administration officials claimed their centerpiece corporate tax rate cut would ‘very conservatively’ lead to a $4,000 boost in household income. New research shows that workers who earned less than about $114,000 on average in 2016 saw ‘no change in earnings’ from the corporate tax rate cut, while top executive salaries increased sharply. Similarly, rigorous research concluded that the tax law’s 20 percent pass-through deduction, which was skewed in favor of wealthy business owners, has largely failed to trickle down to workers in those companies who aren’t owners.” This news is especially disheartening when you learn that the law also included a deep, permanent cut to corporate taxes, from 35% to 21%, and exempted foreign income of multinational organizations from tax.

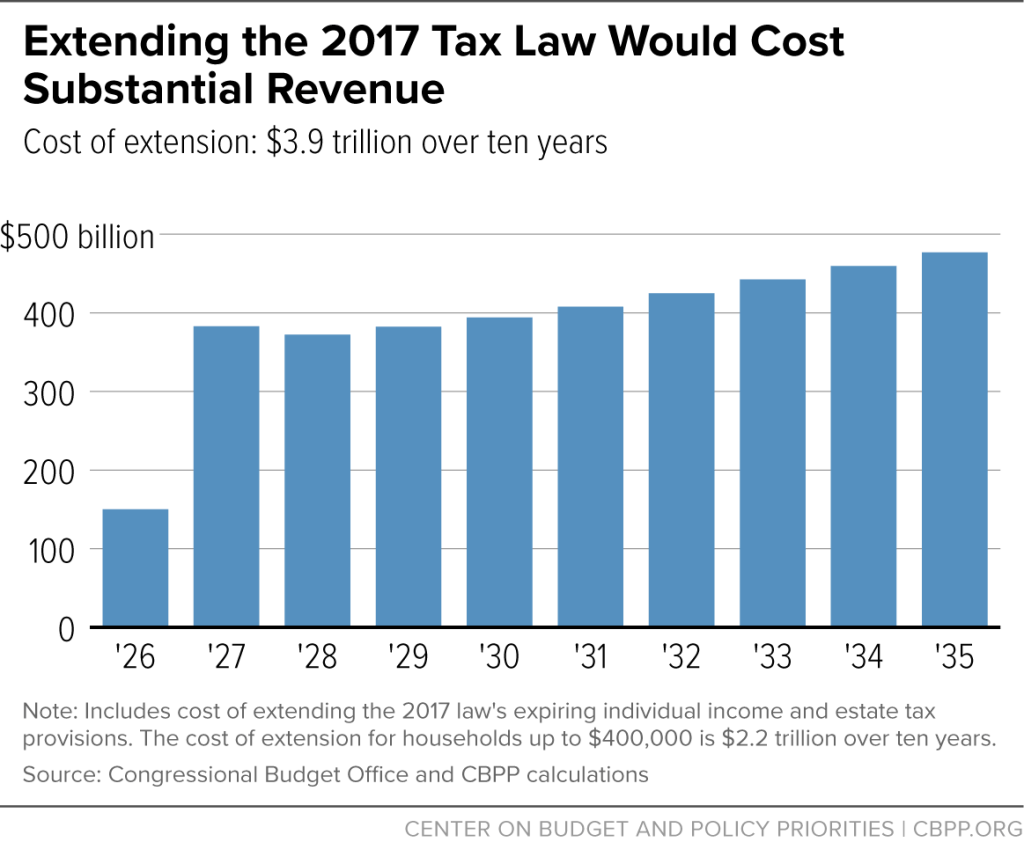

And, like the Bush tax cut before it, Trump’s 2017 tax cut sharply reduced the amount of revenue received by the federal government – revenue needed to fund programs like Social Security, Medicare, and Medicaid. It is estimated that making the Trump tax cuts permanent would cost the federal government $3.9 trillion from 2026 to 2035.

If Trump’s goal is truly to lower the federal deficit, then, considering that income tax is the federal government’s primary form of revenue, one might think that altering the 2017 tax cut to reduce its dramatic cuts for the wealthy might be the best place to start. Instead, Trump is promising to cut taxes for the wealthy and corporations even further.

Trump’s Tax Promises

A hallmark of Trump’s 2016 campaign was tax cuts, and his 2024 campaign wasn’t much different, as he promised to extend his 2017 tax cut and perhaps even bolster it. Trump has floated an increased corporate tax cut from 21% to 15%, no taxes on tips, and no taxes on Social Security. However, these changes would only exacerbate the problematic loss of government revenue caused by the 2017 tax cut. Still, Trump and Republican law makers have been hard at work proposing solutions to pay for the extension of the Trump tax cut and possible further cuts.

Cuts in Federal Spending

Embed from Getty ImagesIn order to balance the budget while maintaining Trump’s Tax Cuts and Jobs Act and possibly increase tax cuts, Trump and congressional Republicans have been hard at work proposing cuts to federal grants, social programs, and tax deductions. Some of the things on the chopping block include:

Tax Breaks for Everyday Americans

The Mortgage Interest Deduction, “Head of Household” tax filing status, American Opportunity Credit, Child and Dependent Care tax credit, Student Loan Interest Deduction, and Lifetime Learning Credit are all tax breaks that primarily benefit the average American that have been proposed to be cut entirely or weakened in order to save the US government money.

Federal Grants

In a test of Trump’s executive powers, the Trump Administration issued an executive order on Monday, January 27th, freezing federal grant money until the programs that depend on the money could be evaluated to be in compliance with the priorities of the Trump administration. While this executive order is intended to exclude Social Security, Medicare, Medicaid, Food Stamps, and Student Loans, this information was not clarified until Tuesday, leaving the nation in chaos as people and programs everywhere that depend on funding from these grants wondered if they would be affected. The White House memo has since been rescinded, but Press Secretary, Karoline Leavitt clarified that, efforts to, “end the egregious waste of federal funding” would continue. This comes as a federal judge moved on Tuesday to block the executive order. The White House response has left it still unclear on how programs that depend on federal grant money like schools, shelters, food pantries, and hospitals will be affected by this evaluation of federal funding.

Education

Trump has promised to end federal funding to schools that push, “critical race theory” and “transgender insanity”, but even more concerning is the push to reduce Title I funding to schools. Trump pushed to reduce Title I funds, which more than 60% of schools rely on, in the last year of his first term, and last year in congress, Republicans proposed at 25% cut to Title I funds. Other proposals include reducing the amount of schools eligible to provide free breakfast and lunch to students, and reforming the Public Service Loan Forgiveness program, which may make it more difficult for teachers and other government employees to receive forgiveness for their student loan debt. If enacted, these cuts may exacerbate the teacher shortage schools, especially those who benefit from Title I, are already experiencing.

Healthcare and Social Services

Another area congressional Republicans have proposed to cut includes reforms for programs like the Supplemental Nutrition Assistance Program (SNAP), Temporary Assistance for Needy Families (TANF), Supplemental Security Income (SSI), and Medicaid, among other reforms. Most of these reforms entail limiting eligibility for these programs with increased work and other eligibility requirements.

The Federal Workforce

The federal government employs nearly 2.4 million people in the United States, compare that to 1.6 million people employed by Walmart, the US’s largest private sector employer, and about 115,000 of these employees live and work in Florida. Like other areas of proposed cuts, the cost of federal employees is a relatively small part of the budget, costing $350 billion of the $6.5 trillion budget. It is yet unknown how much of federal workforce Trump is planning on cutting, but it will no doubt have an impact across the country, not just in DC and Maryland.

Tariffs

Perhaps Trump’s most notable solution to account for the loss of government revenue in taxes is tariffs. This would be accomplished through a 10% tariff across the board on all imports and 25% tariffs on Mexico and Canada, two of the US’s biggest trading partners, starting Saturday. While tariffs have some potential benefits, most economists warn that the cost of tariffs are typically paid by consumers in the form of higher cost of goods, and that increases in tariffs to trading partners can lead to higher tensions and foreign retaliation. The Congressional Budget Office estimates that the 10% across the board tariff could result in a revenue of $1.9 trillion over the course of ten years, roughly the same amount the 2017 Trump tax cut has already cost the US government.

The Rub

The cost of Trump’s reduction in taxes to the federal government is immense, already sitting at a $1.9 trillion loss in revenue since 2017, and it is estimated that it will cost around $3.9 trillion over the course of the next ten years. Evidence shows that this is a tax plan that primarily benefits the wealthiest of Americans far more than it benefits the average American, and in order to offset this cost, Trump is planning on cutting programs that exist to help America’s most vulnerable. Unfortunately, if you review the savings produced by these cuts, cutting these programs likely won’t be able to cover the cost of this loss of revenue, which means the suffering that will result due to these cuts will be for nothing.

The Trump Budget Series

Over the next five posts, I will dive deeper into a discussion about what cuts Trump and congressional Republicans are proposing in order to reduce federal spending. Like this post, these articles strive to paint a non-partisan picture of what reforms are being made and how they will impact everyday US citizens. All of the sources use in this article, like all my articles, are linked, and I encourage you to read these articles for yourself.

Leave a comment