Since it’s a Big, Beautiful Bill, it’s a big, beautiful blog post, folks. After facing weeks of gridlock in the Senate, the GOP’s One Big, Beautiful Bill Act passed in a 51-50 vote, with Vice President JD Vance acting as the tie breaking vote, before it went on to pass the House in a 218-214 vote. After a record-breaking speech from House Democratic leader, Hakeem Jeffries, D-Ny., to delay the vote, Speaker Mike Johnson, R-La., put the Senate’s updated version of the bill to a final vote. Only two Republicans, Thomas Massie of Kentucky and Brian Fitzpatrick of Pennsylvania, voted against the bill, citing concerns over impacts to the national deficit and cuts to Medicaid. The bill was signed into law by President Donald Trump on July 4th, marking a major victory for the Trump administration in their agenda to cut taxes, bolster the fossil fuel industry, and secure funding for Immigration and Customs Enforcement and Homeland Security.

What is the Big, Beautiful Bill?

The GOP’s One Big Beautiful Bill Act is a budget bill that creates key provisions designed to support the Trump administration’s agenda including:

- Increasing Funding for Homeland Security and the Department of Defense

- Renewing and Building Upon the Tax Cuts and Jobs Act of 2017

- Cutting Funding for Medicare

- Cutting Funding for SNAP (Food Stamps)

- Leasing Federal Lands for Resource Extraction and Cutting Funding for the National Park Service and Bureau of Land Management

- Changing Tax Incentives for Clean Energy Companies and Reduces Taxes on Fossil Fuel Extraction

- Adding an estimated 3.3 Trillion to the Federal Deficit Over the next 10 Years

Increases Funding for Homeland Security and the Department of Defense

Embed from Getty ImagesIn order to fund the Trump administration’s actions revolving around mass deportations of immigrants around the country, one of the main purposes of the Big, Beautiful Bill Act is to increase funding for the Department of Homeland Security. This includes $46.5 billion for border wall construction, $45 billion to expand and create detention facilities for immigrants captured by Immigration and Customs Enforcement (ICE), and $30 billion for hiring, training, and resources for ICE. It also imposes a $100 fee for immigrants seeking asylum in the US, which the Senate cut down from the original $1000 fee proposed by the house.

The bill also provides $150 Billion in funding to the Pentagon for various projects like building 16 new naval vessels, investing in new weapons, and creating a “Golden Dome” missile shield. Trump has insisted on investing in the same Iron Dome technology used by Israel to deflect short range missiles, however, scientists who’ve studied using this technology in the United States have pointed out the fundamental differences between the US and Israel in terms of missile defense.

The US is 400 times larger than Israel, requiring greater coverage, and primarily faces threats from long range missiles from Russia or China that would be launched into space before hurtling back to Earth’s surface at hypersonic speeds. Last year, the American Physical Society, a panel of scientists, concluded that in order to counter a rapid salvo of about 10 solid propellant ICBMs similar to North Korea’s Hwasong-18 missiles, the US would need a constellation of 16,000 satellites in orbit with advanced Golden Dome technology. The Pentagon is currently planning on using $25 billion from the One Big, Beautiful Bill Act to fund a project that would place 2,000 Golden Dome satellites in space. And it is estimated to cost the US $4 to $5 billion per year to maintain such a project, since satellites regularly need to be replaced.

Renews and Expands the Tax Cuts and Jobs Act

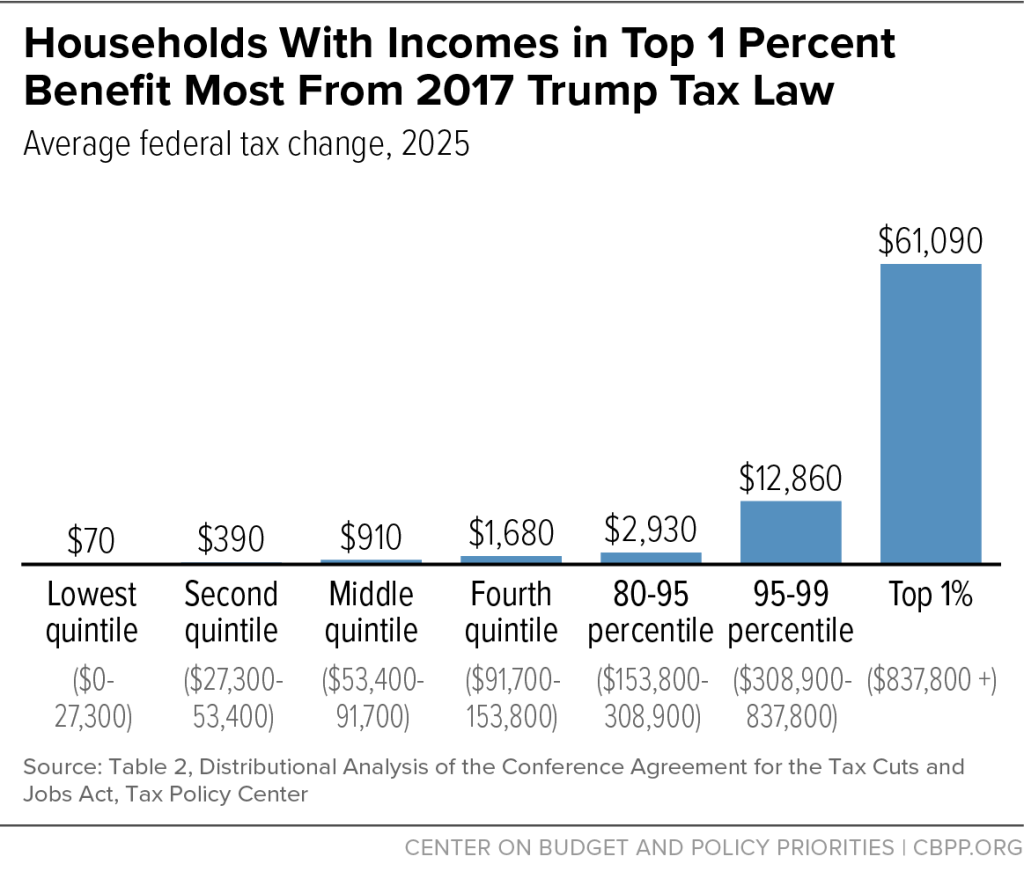

The 2017 Tax Cuts and Jobs Act passed under the first Trump administration is set to expire at the end of this year, so one of the main purposes of the massive budget bill is to renew and expand these cuts. The Tax Cuts and Jobs Act, which has already cost the US government an estimated $1.9 trillion in revenue loss according to the Congressional Budget Office, resulted in an average of 0.9% in savings for Americans in the bottom 60% of earners with the top 1% over earners saving triple that at 2.9%. The following table shows the disproportionate savings for America’s top 1% of earners compared to the average American household. For reference, the bill would save someone like me, a teacher in the second quintile, around $390 per year.

But the One Big Beautiful Bill Act extends these cuts and add new tax breaks, including creating new deductions for taxes on tips, overtime, senior income, and interest on car loans, raising the cap on SALT deductions, increasing the Child Tax Credit, and creating several deductions for businesses in the manufacturing and the fossil fuel industries.

- Tax Deductions for Tip Earners: The act would make up to $25,000 in income for earners in traditionally tipped industries tax deductible for tax years 2025-2028.

- Tax Deductions on Overtime: The act would allow overtime earners to deduct up to $12,500 in overtime compensation from their taxes for tax years 2025-2028.

- Deductions for Seniors: The act would allow for $6,000 in income for seniors to be tax deductible from 2025-2028.

- Deductions for Interest on Auto Loans: The act would allow up to $10,000 in interest on car loans for new cars with final assembly in the United States to be deducted from 2025-2028.

- Raises Cap on SALT Deductions: Itemized deductions, which are primarily used by the top 10% of earners in the US, on SALT or state and local income tax, which are currently limited to $10,000 in deductions, will be raised to a cap of $40,000 from 2025 to 2029.

- Extends and Increases the Child Tax Credit: The Child Tax Credit of $2,000, which would expire at the end of 2026, will be extended and increased to $2,200 per year.

- Repeals Green Energy Tax Credits from the Inflation Reduction Act: Individuals who drive electric vehicles or have made energy efficient improvements to their homes will no longer receive tax credits.

- Repeals Tax Cuts and Credits for Clean Energy Businesses: We’ll dive deeper into this later, but the bill repeals credits and exemptions for companies pursuing clean energy practices and innovations.

- Permanently Allows Businesses to Deduct Research and Development Expenses and Temporarily Allows Businesses to Expense Qualifying Structures: This primarily benefits companies in manufacturing and the fossil fuel industry by allowing them to write off new building projects on their taxes.

- Permanently Increases Estate and Lifetime Gift Tax Exemption: The act would allow up to $15 million for single filers and $30 million for joint filers in real estate or gifts to be tax exempt. This primarily benefits wealthy individuals who inherit real estate or gifts by preventing them from being taxed on their inheritance.

And while many of these provisions may at least temporarily save some Americans a little money, like the Tax Cuts and Jobs Act, the bill primarily benefits the top 1% of earners and the oil and gas industry. The Trump administration and members of congress claim that the bill will create new jobs in the oil and gas industry and the manufacturing companies that will benefit from the bill. According to the Tax Foundation, it is estimated that these tax cuts will increase the GDP by 1.2% and increase working hours by an equivalent of 938,000 full time jobs. However, it’s important to remember that the cuts to the federal workforce and cuts to the tax breaks that have grown the green energy industry over the last few years have and will result in an incredible number of jobs lost.

Since January, the Trump Administratio has laid off nearly 60,000 people and around 75,000 accepted buyout offers, and the administration has a goal of cutting around 275,000 people from the federal workforce. In the clean energy industry, the Center for American Progress estimates a loss of 840,000 jobs by the end of the decade. The other thing that’s important to consider here is that one job loss and one job opening don’t necessarily even out. Federal workers with master’s degrees in public policy that work in Washington, DC aren’t filling job openings on oil rigs in the Gulf of Mexico. Meteorologists laid off from the National Weather Service in Norman, Oklahoma aren’t filling manufacturing jobs in Pennsylvania. But the cuts to the federal workforce and clean energy initiatives aren’t the only thing footing the One Big, Beautiful Bill Act.

Cuts to Funding for Medicaid

Work Requirements

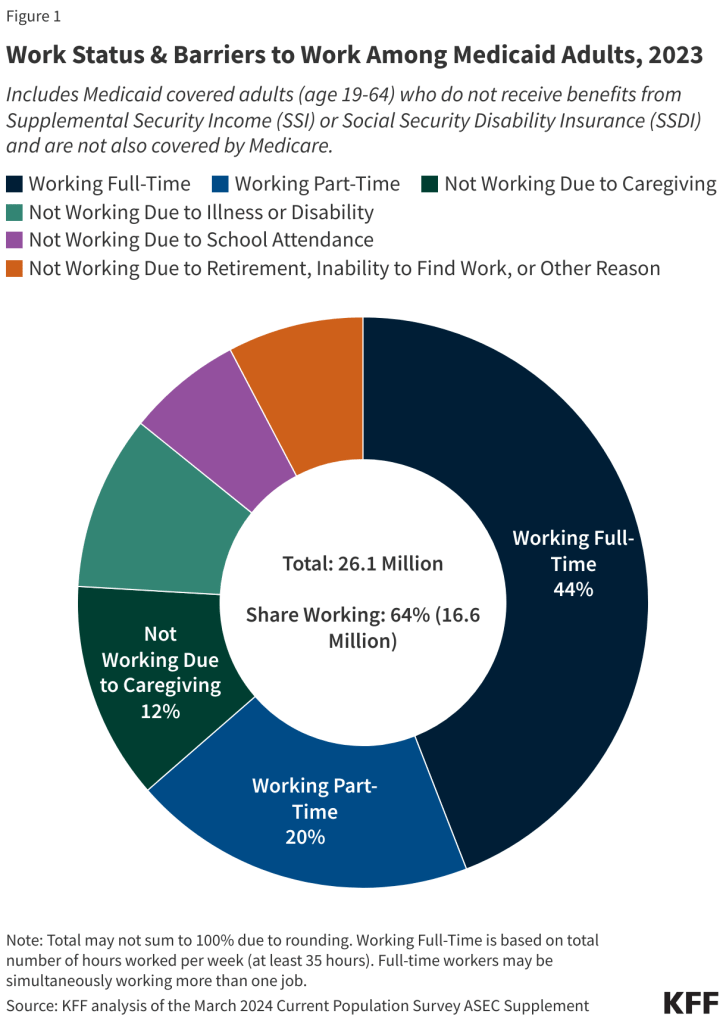

The Big Beautiful Bill includes $800 billion in cuts to Medicaid over the course of the next ten years, which the Congressional Budget Office estimates will leave 11.8 million Americans without access to health care. These cuts come from two major provisions: increased work requirements for Medicaid recipients and, you guessed it, tax cuts. New work requirements would require Medicaid recipients to work, volunteer, or attend school at least 80 hours per month, unless they qualify for an exemption. According to the Kaiser Family Foundation, an independent source for health policy research, 64% of Medicaid recipients work full or part time, while the rest face obstacles to working like school attendance, caregiving responsibilities, or illness or disability. The following infographic shows a breakdown of individuals currently on Medicaid.

The One Big, Beautiful Bill does provide exemptions for American Indians, disabled veterans, those considered medically frail by a healthcare provider, parents of dependent children, pregnant women, those with substance abuse disorders, those recently released from prison, and individuals experiencing hardship. However, the real issue here is the red-tape individuals who qualify for these exemptions or who are already working will have to cut through in order to avoid gaps in coverage. Furthermore, data from Arkansas and Georgia, the only two states to impose work requirements for Medicaid, have shown that these programs did not result in increased employment and instead resulted in loss of coverage due to confusion among Medicaid recipients and administrative errors when processing eligibility checks. Furthermore, the programs ended up costing the states money in the administrative costs associated with processing eligibility checks.

Of course, many who are proponents of these work requirements have described work requirements as only applying to “able-bodied” individuals, however, those with disabilities that do not meet criteria to receive Supplemental Security Income and disability status often depend upon Medicaid for healthcare. As well, since states have discretion over Medicaid programs in their state, it’s important to note that different states have different definitions of what qualifies as a disability. For instance, in my home state of Oklahoma, it’s nearly impossible for people with epilepsy, like myself, even in crippling cases of the disorder, to qualify for disability status. Yet, epilepsy, if not treated by medication (which 40% of individuals with the disorder are not), results in an inability to drive, which in most places in the US severely limits an individual’s access to jobs. Furthermore, if individuals with epilepsy, like individuals with other disorders, are able to find a job, they may face job loss due to experiencing seizures at work or missing work due to health complications or doctor’s appointments. As far as qualifying for exemptions to prevent lapses in coverage or recover their Medicaid after a lapse in coverage, patients may face months long waits to get in with health care providers who can fill out the proper paperwork, if their state will even recognize their case as worthy of an exemption.

New Copays and Provider Tax Reductions:

Another provision related to Medicaid in the One Big Beautiful Bill Act includes introducing a new $35 copay for Medicaid recipients and higher bills for individuals who visit the emergency room for “non-emergencies”. Studies have shown that increased copays may reduce necessary and unnecessary doctor’s visits and result in non-adherence behaviors when taking prescription drugs. Other studies found that this avoidance of seeking preventative healthcare, like visits to a specialist or use of prescriptions as directed by doctors in order to reduce financial burden, resulted in increased emergency room visits and hospitalization costs.

The bill also cuts provider taxes from 6% to 3.5%, ultimately reducing the amount of money states have to fund rural hospitals and providers that would otherwise be paid by Medicaid. Researchers from the Cecil G. Sheps Center for Health Services Research found that the limit to provider taxes would push more than 300 rural hospitals towards service reductions or closure. Most of these hospitals, in places like Oklahoma, Florida, Kentucky, Louisiana, and California operate on narrow profit margins as it is. In 2017, when the state of Oklahoma’s state budget crisis resulted in possible delays in Medicaid reimbursements to hospitals, the CEO of Hillcrest Hospital Claremore, the rural hospital in my hometown, said the following.

“It’s very important for our hospital – and the greater Claremore

community – to have a stable and sustained Medicaid program…”

This is the hospital I was born in and where my mother worked as a nurse for over 25 years. It serves not only the small town of Claremore, but its rural surroundings, and provides vital access to healthcare for people that would otherwise have to drive forty minutes to an hour to the next closest hospital.

After lawmakers from rural states expressed distress over the possible closures, a provision was added to creation a $25 billion fund called the Rural Health Transformation Fund to prevent the closure of rural hospitals. However, the National Rural Health Association found that the fund falls short of what is needed to sustain rural hospitals. The estimated $58 billion in loss of funding for rural hospitals over the next ten years is far from offset by $25 billion over the same period of time. The fund was increased to $50 billion in the bill’s final form, which is still short of the estimated $58 billion in losses under the bill. The Center for American Progress points out that the relief fund is set to phase out after five years, which leaves major gaps in funding for rural hospitals that rely on funding from Medicaid. With many rural hospitals already operating on razor thin margins, and as many as 44% operating in the negative, many rural hospitals and nursing homes fear they will be facing closure.

Limits Access to Healthcare for Women on Medicaid

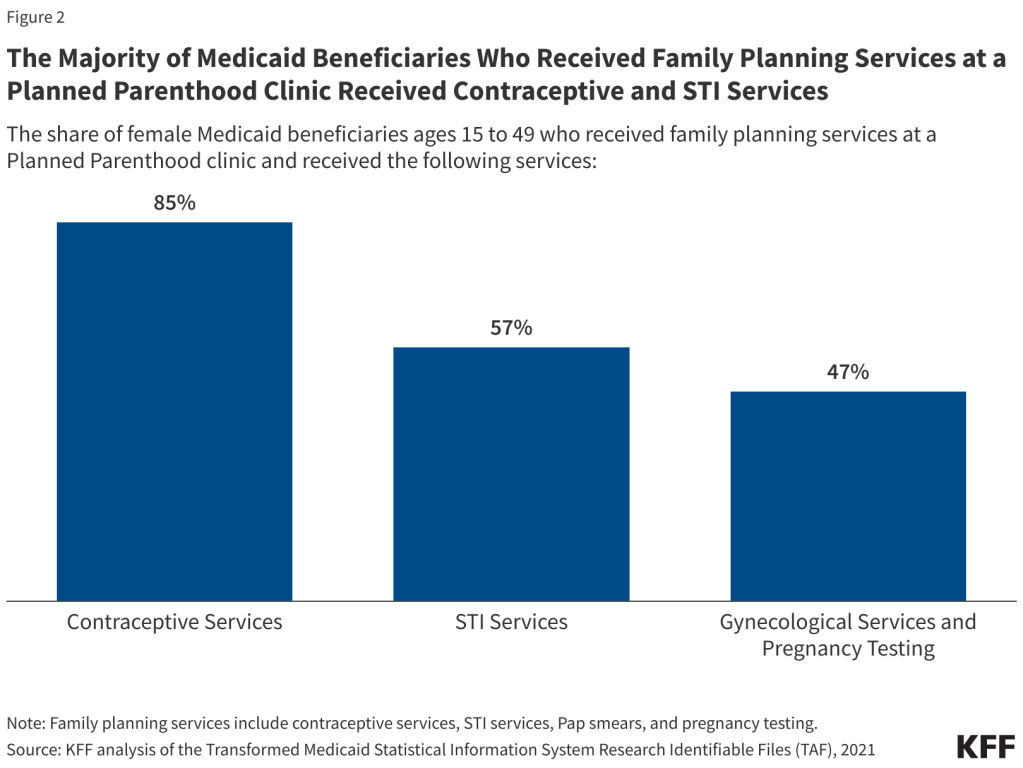

The Big, Beautiful Bill also contains a provision preventing Medicaid recipients from receiving care from facilities that also perform abortions. This is effectively a provision designed to defund Planned Parenthood, but, at its core, it limits women’s access to contraceptives, STI screenings and treatment, and gynecological services like pregnancy care and cancer screenings. 1 in 3 women are estimated to have received care at Planned Parenthood and between 2022 and 2023, abortion made up only 4% of the total services provided by Planned Parenthood. It is important to note that since the Hyde Amendment in 1977, Medicaid funds have only been used to provide abortion care in cases of rape, incest, or the endangerment of the life of the mother. The following chart shows a breakdown of the use of Planned Parenthood’s services by Medicaid recipients.

Now, Medicaid recipients will no longer have access to these services through Planned Parenthood and similar clinics, restricting women’s access to prenatal care, STI screenings, pap smears, and breast cancer screenings. Furthermore, the cuts may result in the closure of 1 in 3 Planned Parenthood clinics, limiting access to these services by women who are privately insured. A federal judge has temporarily blocked this provision in the One Big, Beautiful Bill Act, as Planned Parenthood has filed a suit alleging that the provision targets their organization and will cause irreparable harm.

Cuts Funding to SNAP

Like the cuts to Medicaid, one provision cutting funding to the Supplemental Nutrition Assistance Program (SNAP) is a new work requirement that raises the age of individuals required to meet work requirements to qualify for SNAP. SNAP, also known as food stamps, currently requires that recipients between the ages of 18 and 54 meet work requirements, however, it will now require individuals between the ages of 18 and 64 to meet work requirements.

New provisions also shift more financial responsibility for SNAP payments to the states, with the federal government now requiring states with error rates (rates of over payments or under payments to SNAP beneficiaries) of over 6% to pay between 5% and 15% of the cost. In 2023, only 7 states had error rates of 6% or less. These new restrictions, like those applied to Medicaid, will no doubt result in more paperwork and red tape to be addressed by both SNAP recipients and the states that will have to foot the bill. This $186 billion funding cut, like the Medicaid cuts that accompany it, is the largest cut in the program’s history.

Leases Federal Lands for Resource Extraction and Cuts Funding for the National Park Service and Bureau of Land Management

Embed from Getty ImagesLeases of Public Lands

If you’ve read my last two posts which detail the Trump administration’s plans to increase logging, mining, and petroleum extraction on federally protected lands, then these provisions will come as no surprise to you. The One Big, Beautiful Bill opens 4 million acres of public land to leases for coal mining and reinstates oil and gas leases within the Arctic National Wildlife Refuge. Leases within the Arctic National Wildlife Refuge were restricted under the Biden Administration in order to protect species like the Porcupine Caribou (seen above), Spectacled Eider, and Polar Bear, which are all classified as “Threatened” under the Endangered Species Act of 1973.

Alaska will receive most of the royalties from these fossil fuel operations, which was a key selling point for Senate Republican holdout, Lisa Murkowski (R-Alaksa), who eventually voted to pass the bill into law. The Arctic National Wildlife Refuge is located in the homelands of the Iñupiat and Gwichʼin indigenous peoples who depend on the Porcupine Caribou herd for their traditional way of life. To read more about the proposed drilling and mining sites and their potential impacts on endangered species, read my last post.

Cuts Funding for the National Park Service and Bureau of Land Management

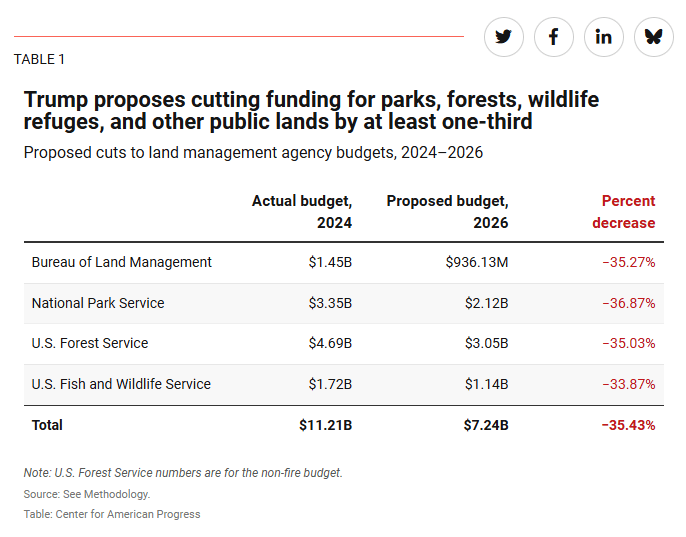

Again, if you read my post on Trump’s workforce cuts to the National Park and US Forest Service, these provisions won’t come as any big surprise. The Big, Beautiful Bill cuts funding for the National Park Service, the Bureau of Land Management (BLM), the US Fish and Wildlife Service, and the US Forest Service each by over a third of their respective budgets from fiscal year 2024. This makes up around $4 billion in cumulative cuts to these agencies, which are primarily responsible for ensuring the protection of federally protected lands, the ecosystems within them, and wildlife species throughout the United States.

This cut to the National Parks is the largest in the agency’s history, cutting per visitor spending to 55% less than its 2011 levels when adjusting for inflation. Proposed employment for these agencies will be 30% less than 2024. As I discussed in my previous post on workforce cuts to the parks and US Forest Service, this lack of staff can lead to longer response times to emergencies, like rescuing injured hikers in the backcountry. Furthermore, current and former Park staff have expressed concerns about the ability to maintain clean parks and healthy ecosystems. Previous workforce cuts resulted in the loss of researchers studying endangered species and vital ecosystems in the parks, which ultimately wastes taxpayer dollars as their federally funded research goes unfinished.

It’s estimated that US National Parks bring in around $55.6 billion to the US economy each year, making them a worth-while investment. Now, many parks may be sold off, privatized, or transferred to the states, which ultimately may not be able to fund them. Certainly, with Park visits increasing year by year, it will be a difficult task for parks to operate with only two thirds of their previous staff. These cuts will ultimately result in fewer jobs, less protection and research over the US’s native ecosystems, and fewer parks, which ultimately means less money in the US economy.

Changes Tax Credits and Incentives for Clean Energy and Reduces Taxes on Fossil Fuel Extraction

Individual Tax Credits

The Biden Administration’s Inflation Reduction Act introduced tax incentives to promote investment in the clean energy industry which the One Big, Beautiful Bill now cancels. One of the provisions in the bill repeals tax credits for individuals that own electric vehicles or make energy efficient improvements to their homes. Previously, individual taxpayers could receive a $7,500 tax credit for purchasing a new electric vehicle or a $4,000 tax credit for purchasing a used one, but these tax credits are now set to expire.

Clean Energy Tax Credits

Embed from Getty ImagesThe Big, Beautiful Bill also eliminates the clean energy production and investment credit after 2027. The Senate’s changes to the bill did, however, include an exception for projects that begin construction within 12 months of the bill’s passage. It also restricts companies owned or invested in by “Foreign Entities of Concern” from receiving these credits. The bill does include some potential upsides for existing clean energy companies. It adds income from hydrogen storage, carbon capture, advanced nuclear, hydropower, and geothermal energy to qualifying income of certain publicly traded partnerships treated as C corporations, meaning clean energy corporations may pay less in taxes. It also extends the clean fuel production credit until 2030 and expands the credit.

Some estimate that these cuts could result in 50% fewer additions from clean energy to the US power grid over ten years. Likely due to the Inflation Reduction Act’s tax incentives for clean energy, the US added 49 gigawatts of from clean energy to the US electricity grid in 2024 and is set to add almost 60 gigawatts in 2025. One estimate calculated that the One Big, Beautiful Bill will slash those yearly additions down to 13 gigawatts per year over the next 10 years. Another metric shows increased utility bills, as large data centers vie for more and more of the energy grid and US experiences record heat waves. As well, another estimate shows 840,000 jobs lost from clean energy over the next ten years due to faltering investment in clean energy projects.

Cuts to Royalties on Fossil Fuels

The bill cuts the Inflation Reduction Act’s increase on royalties on oil, gas, and coal production. Oil and gas royalties will be reduced from 16.6% to 12.5%, and coal royalties will be reduced from 12.5% to 7%. These changes are a big win for the oil and gas industry, and are a big step towards what the Trump administration calls “US Energy Dominance”. However, because these royalties are a major source of revenue for the federal government, these cuts are a major contributor to the One Big Beautiful Bill Act’s hefty price tag.

$3.3 Trillion Added to the Federal Deficit

As previously stated, the One Big, Beautiful Bill, which includes $4 trillion in tax cuts, is estimated by the Congressional Budget Office to result in $3.3 trillion added to the federal deficit over the course of the next ten years. The Tax Foundation estimates that the bill will ultimately result in an increase to the US’s GDP of 1.2% over the course of the next ten years. However, they also estimate that, due to the increase in the federal deficit, the US’s debt-to-GDP ratio will rise by 9.6 percentage points. The debt-to-GDP ratio is used to calculate risk of default and can result in higher interest rates due to its impact on the US’s credit. It is also important to note that the Tax Foundation calculates that $3.8 trillion will be added to the federal deficit, which is $400 billion higher than the CBO’s projection.

Is There An Upside

Overall, whether or not you view the bill as net positive or net negative will come down to your political perspective. The bill does provide some modest tax breaks that may benefit middle class Americans over the next three years, and the tax breaks for businesses, particularly in manufacturing and the fossil fuel industry, should provide a boost to those sectors of the economy. The bill is estimated to boost the GDP and create jobs in manufacturing and resource extraction. However, all of these benefits come at a cost. The cuts to Medicaid, the National Parks Service, BLM, the Forest Service, and Fish and Wildlife Service will result in the loss of jobs for rural hospital staff, park rangers, and other federal workers. It also puts natural and cultural landmarks at risk, which may impact those who work in the hospitality industry that depend on tourism to National Parks and federally owned land. The cuts to clean energy programs will not only reduce jobs in that sector, but it will also put the US behind other countries that are investing in clean energy. And, at a $3.3 trillion price tag, it’s definitely a risky investment that many Americans feel they are paying for.

Author’s Note

I’d love to hear opinions in the comments below, and if you’re interested in my sources, I’ve linked them throughout the article. If you loved this post, you’ll love my other posts too, so definitely go check those out. Stay tuned for more posts breaking down funding cuts as a part of my Trump Budget Series and definitely check in for more posts on the environment, travel, and upcoming posts on literature!

Leave a comment